GST in Advance

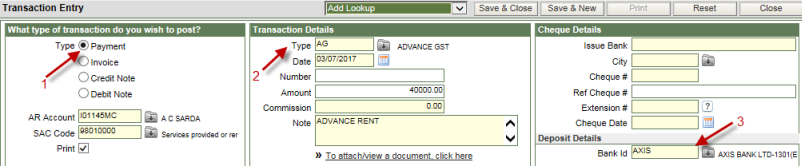

Advance received is a Payment received in Receivables. Therefore, in the Transaction Entry Screen, when recording Advance,

-

the type will be Payment

-

the transaction type will be the advance transaction type

-

the Bank Id in which the amount will be received.

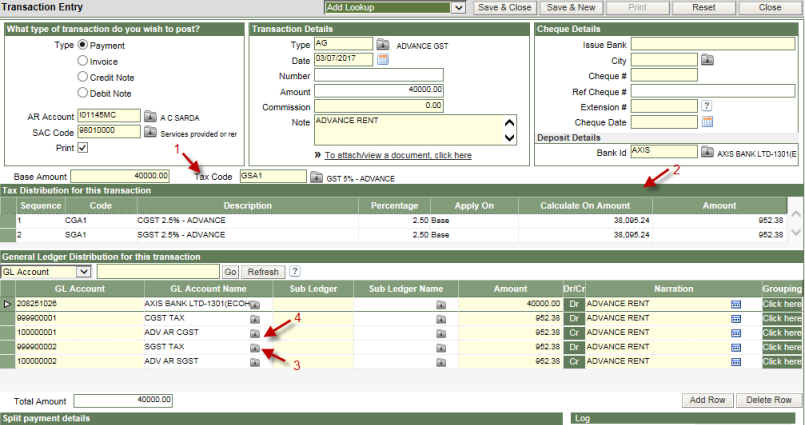

On selecting the SAC code for the service, for which the advance is being received , the system automatically displays the

-

Tax Code

-

The GST component - CGST, SGST or IGST

-

The corresponding GL Distribution of CGST, SGST or IGST

-

The corresponding Advance GL Distribution of CGST, SGST or IGST, for which the hotel will claim a refund, when the advance is settled with the final invoice. ** These GL account codes are defined in the advance controls - ARGSCA, ARGSIA, ARGSSA.

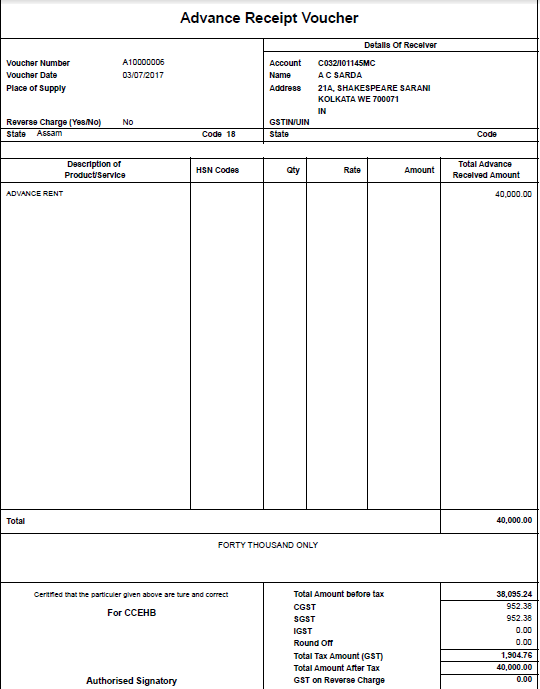

The advance receipt printed is: