Setup for GST

There a couple of parameters that is required to be setup, for GST to work in Receivables.

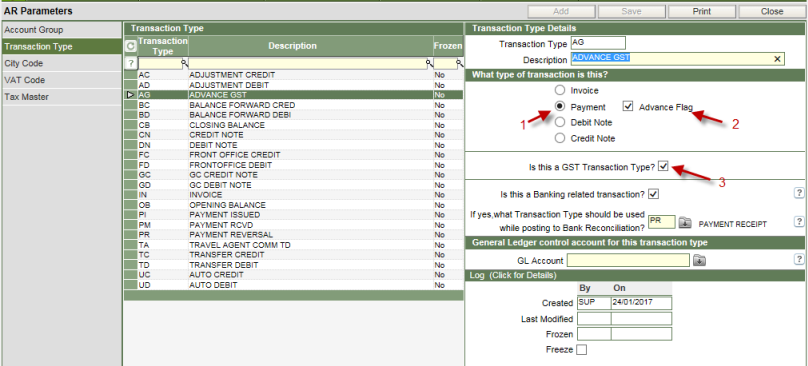

In the transaction type section of the AR Parameter Screen, a new type of transaction has been introduced to record Advance transactions with GST.

The transaction type is of

1. Type - Payment

2. The advance Flag is ticked.

3. The indicator that it is a GST transaction type is also ticked.

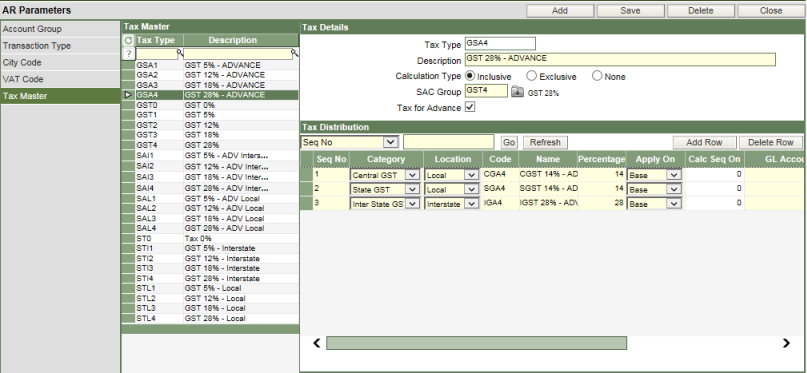

In the Tax Master section of the AR Parameters, each of the GST percentages, for CGST,SGST and IGST has to be defined. Also, the tax percentages that are applicable on Advance transactions, is to be specified. GST on advance received, is inclusive of the advance amount. Example: An advance of 4,00,000 received @ 18% GST. The GST amount will be calculated as:

(4,00,000 * 18) / (100+18) = 61,016.

-

Type in the TAX type, which is a 4 character unique TAX Code.

-

Type in the Description of the code.

-

Select the calculation type as - Inclusive, if the tax will be used to apply on Advance Received. Select - Exclusive, if the tax is to be applied over and above the amount.

-

SAC Group is the Tax Class. This is NOT a mandatory field.

-

Select the option of Tax for Advance, if the particular tax code will be used for advance received transactions.

-

In the Tax Distribution Section, define the following

| S.No | Column name | Description |

| 1 | Seq No | This is the order of defining the GST components |

| 2 | Category | The category can be any one of the three - CGST, SGST or IGST |

| 3 | Location | As per what has been selected in the previous column, the system defaults the location, which can be local or inter-state |

| 4 | Code | Type in the 4 character code for each CGST, SGST and IGST |

| 5 | Name | Type in the description of the code entered in the previous column. |

| 6 | Percentage | type in the percentage of the tax |

| 7 | Apply On | the option to be selected is Base |

| 8 | Calc Seq On | this field is NOT Applicable |

| 9 | GL Account | The GL Account that should be effected on applying CGST, SGST and IGST. |