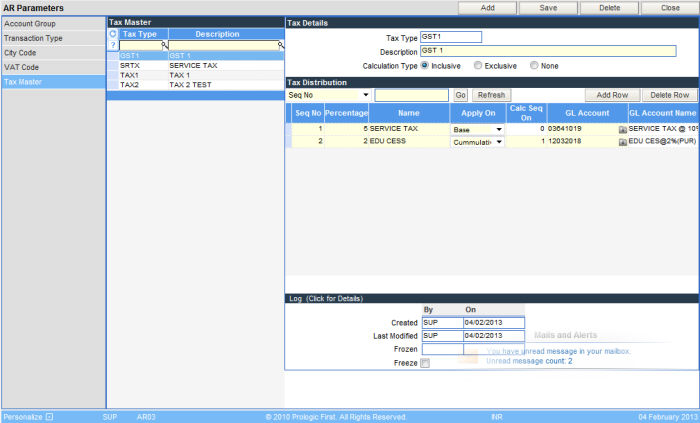

Tax Master

The Tax master parameter is being specifically used by countries, which have GST (Goods & Service Tax). This screen allows to setup complex tax structures that have both cumulative & base taxes.

The screen displays the list of Taxes already created on the left half. As you click on a specific Tax from the list, the details of the structure is displayed on the right half of the screen.

1. Type in the 4 character Tax Type code. This can be an alphanumeric Tax code.

2. Enter the description of the Tax Type.

3. The calculation type, which is how the sub taxes that form the complete structure will be calculated. It can be Inclusive or Exclusive, based on the option selected. Inclusive indicates that the total value of an Invoice, includes the tax components and Exclusive indicates that the taxes will be calculated on the total value of the Invoice.

4. Enter the tax components one by one. The details that needs to be entered are:

| S.No | Column name | Description |

| 1 | Seq No | This is the order in which each of the tax component should be applied while tax calculation. |

| 2 | Percentage | This is the percent value of the tax that should be applied. |

| 3 | Name | The description or the name of the tax. |

| 4 | Apply on | This can be, on base amount or cumulative amount. Base amount indicates that the tax percentage will be calculated on the net amount of the Invoice. On the other hand if it is cumulative then the tax percentage will be calculated on the net amount + any other applicable tax. |

| 5 | Calc Seq on | This is the sequence or order that the system will follow to compute the tax. For example, if the tax is to be calculated on the first tax in the sequence, then the value in this column will be 1. |

| 6 | GL Account | This is the Tax GL account code as defined in the Chart of Accounts |

5. More tax components can be added using the Add Row button.

6. After entering the complete Tax structure, click the Save button on the top right of the screen, to complete the process.