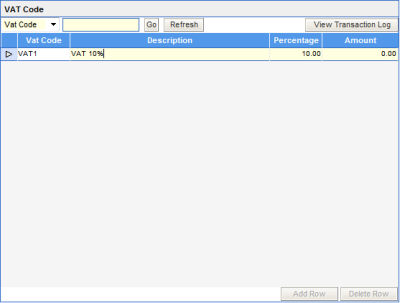

Vat Code

This section of the parameters is used only if VAT input needs to be recorded at the time of raising invoices or debit notes. In most scenarios, VAT will be handled in the front office PMS, for transactions settled to the City Ledger.

This parameter can be defined only if the control - Show VAT details in the AR controls screen is ticked.

1. Type in the 4 character VAT code. This can be a alphanumeric code.

2. Enter the description of the code.

3. Type in the percentage value of the VAT code.

4. Type in the amount if the VAT is a amount figure and NOT a percentage.

5. Click the Add Row button at the bottom to continue adding for VAT codes.

Once the entire list of VAT are typed in, click the Save button at the top of the screen to store the same into the database.